Insights

Well-Being Greater in More Economically Free Countries, Says Fraser Institute Report

Featured

Well-Being Greater in More Economically Free Countries, Says Fraser Institute Report

Latest

All Articles ()

There are currently no articles for this filter

Boston - For the past 27 years, Canada's Fraser Institute has published the annual "Economic Freedom of the World" report, which examines the links between a country's economic freedom, the well-being of its citizens and its economic growth.

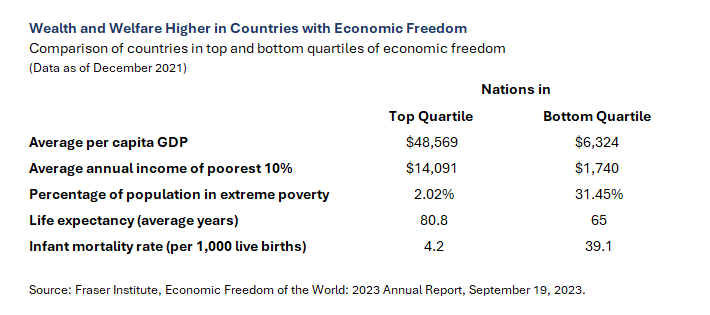

Based on data from 165 countries,1 the 2023 report points to a sharp drop in world economic freedom relating to pandemic policies and highlights how socioeconomic well-being is greater in those countries with policies and institutions more supportive of economic freedom. The report draws from 2021 data, the most recent and comprehensive available.

A key component of the report is the Economic Freedom of the World (EFW) Index — a core data set used in the Emerging Markets Debt (EMD) team's analyses. The index ranks countries on five broad areas: size of government, legal system and property rights, sound money, freedom to trade internationally, and regulation.

Hong Kong relinquishes top spot to Singapore

For the first time in the history of the index, Hong Kong fell to second place after scoring lower on regulation, due to tighter Chinese restrictions on foreign labor, increased barriers to entry and higher costs of doing business. Its legal system and property rights rating also fell, partly because of eroding confidence in the judicial system and courts.

In contrast, Singapore rose to the top spot on improvements in its size of government and regulation components. Rounding out the top 10 highest-scoring nations are Switzerland, New Zealand, United States, Ireland, Denmark, Australia, United Kingdom and Canada. The lowest-scoring countries include Republic of Congo, Algeria, Argentina, Libya, Iran, Yemen, Sudan, Syria, Zimbabwe and Venezuela.

Economic freedom correlated to socioeconomic outcomes

This year's report also highlights that well-being is much greater in economically free countries, as measured by average income, life expectancy, infant mortality rates and depth of poverty. Notably, the average income of the poorest 10% in the most economically free nations is more than twice the average income of all people in the least free nations.

Overall, the index shows increases in countries' economic freedom since 2000, but the world average has fallen from 6.94 in 2019 to 6.77 in 2021, undoubtedly impacted by the coronavirus pandemic, among other factors. This drop is 2.5 times larger than the global decline witnessed in the 2008-2009 financial crisis.2 Legal system and property rights, freedom to trade internationally, and soundness of money supply were the three areas of economic freedom which, on average, saw the largest declines.

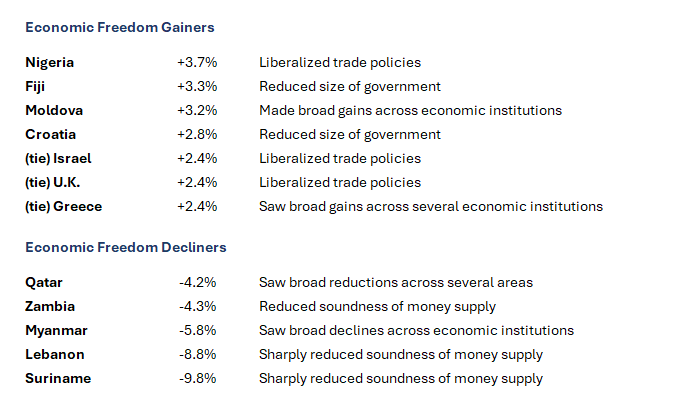

Following are some notable gainers and losers in countries followed by the EMD team:

Bottom line: The current Fraser Institute report highlights the positive link between economic freedom and the wealth and welfare of nations. Partially driving the recent drop in world economic freedom is higher inflation, which has taken a toll on the soundness of the money supply in many countries. And, in many instances, pandemic responses have led to more restrictive government policies. For more detailed analysis, please refer to Fraser Institute's 2023 Economic Freedom of the World annual report, available online.

1. Fraser Institute, Economic Freedom of the World: 2023 Annual Report, September 19, 2023.

2. The Economic Freedom of the World (EFW) Index is based on 2021 data, the most recently available.